UK ?? REMORTGATE SAVINGS

Qualify For A Free Remortgage Assessment To Save On Your Mortgage

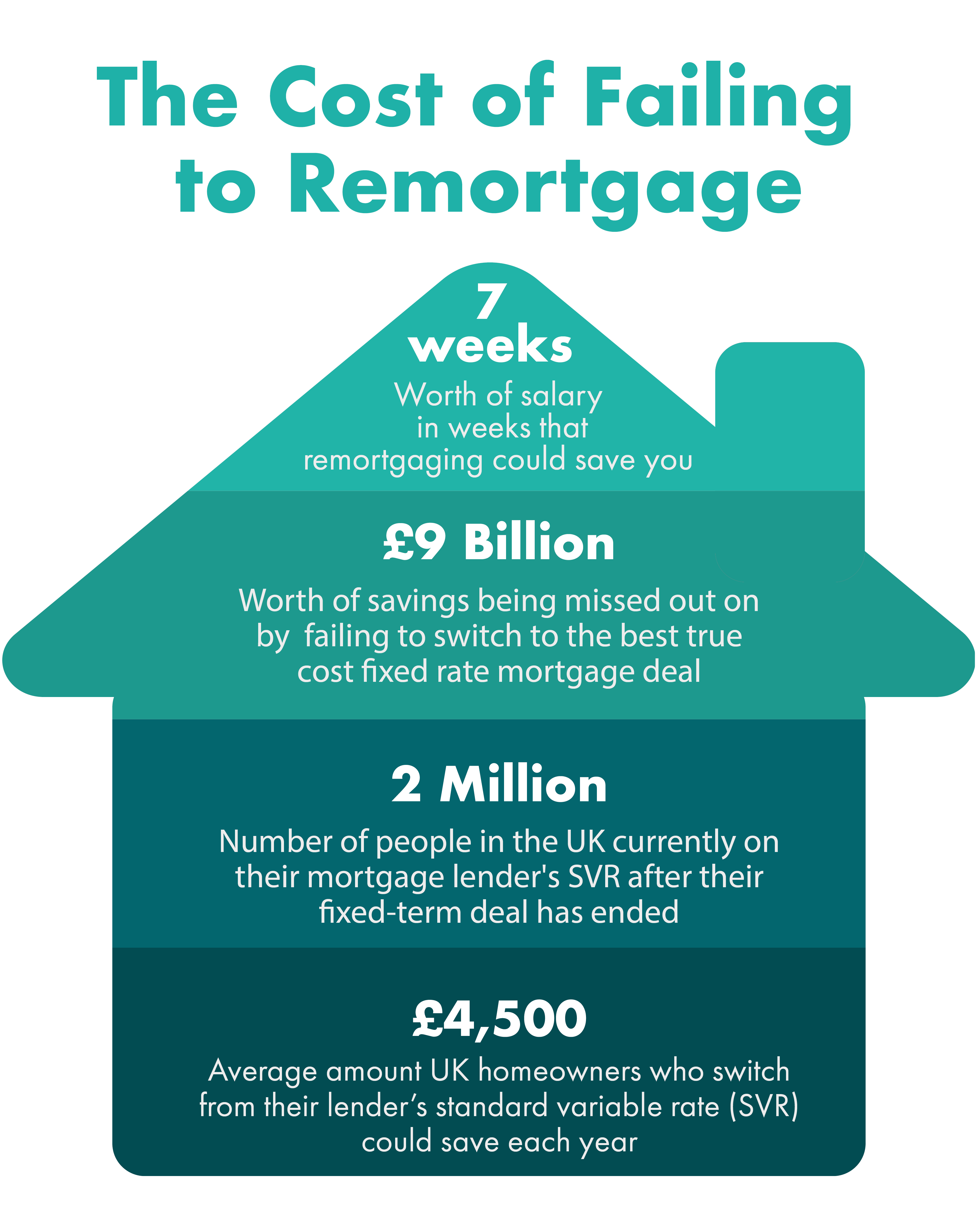

Millions of people are effectively paying too much each month by not switching to a better deal.

Start Saving Now

By fully or partially completing this form you agree to the privacy policy and terms & conditions of our website

Potentially Save £1,000's With The Right Deal

Low interest rates from 1.09% For Remortgaging

Millions of Brits ?? Are OVERPAYING On Their Mortgage

Are YOU Getting The Best Remortgage Deal?

Millions of people are effectively paying too much each month by not switching their mortgage to a better deal.

Our mortgage brokers have access to a choice of top lenders to find you a remortgaging deal that works best for you. By understanding your re-mortgage options first, they can shop around for the best rate and potentially save you thousands of £££s each year on your mortgage payments.

Enquiring with us only takes 30 seconds and won’t affect your credit score.

- Access historically low interest rates to reduce your monthly repayments immediately

- Opportunity to fix your mortgage on long-term low interest rates

- Change your term to reduce your monthly payments or pay off your mortgage earlier

3 Reasons To Shop Smart For Your Mortgage

Check if you Qualify:

Your information is secure.

How it works - It takes 60 seconds

Complete the simple enquiry form.

We search for the best mortgage deals.

Discuss with a qualified mortgage advisor.

Find Great Remortgage Deals Today

It’s likely you shop around for the best deals for your broadband or mobile phone so why not do the same with your mortgage?

- Sticking with the same mortgage provider is very rarely beneficial to you and in most cases you will be better off by finding a new mortgage deal.

- If your current mortgage deal is soon to end then now is the right time to find a new mortgage so that your existing lender doesn’t put you on its standard variable rate (SVR).

- You can avoid any worry about interest rates going up by remortgaging at a fixed rate that gives you greater financial certainty.

- If your home’s value has gone up since you took out your mortgage, you may find you are in a lower loan-to-value band, and therefore eligible for much lower rates.

Check if you Qualify:

Your information is secure.

Our Partners Have Helped 100,000's Of People - Like These Happy Customers

Alice provided excellent support and advice throughout the process of obtaining a mortgage. I would definitely recommend her services to any new potential customers.

Harriette made things very easy throughout the whole process. Everything was handled professional and in a timely manner. Harriette was very quick to respond with any questions. Highly recommended.

From the initial enquiry to the completion, the service I received from Harriet from FAC was exceptional. She kept me updated at every stage, was friendly and knowledgeable and got me a great deal, taking a third off my monthly mortgage payments! I’ve recommended her to several friends and would definitely use her and FAC again in the future.

It Takes 60 Seconds....

Provide just a few quick details and we’ll have you in touch with a mortgage advisor who will carry out a free assessment and help you get you the best deal. There’s no obligation so there’s nothing to lose.

By taking just 60 seconds to make an enquiry could be the start of a better deal allowing you to start making savings immediately. Over the term of your mortgage, the savings you make will allow you to do better things with your money, or even use the savings to look to pay a larger chunk of your mortgage off earlier.

You can even use remortgaging as a means of lending more, as going to a new lender can often be a means of raising money cheaply on low rates.

Check if you Qualify:

Your information is secure.